Information and guidance for informed decision-making

Increased profitability

Predictive analytics and alarms. Process automation

Why Us?

We analyze your company

We identify business opportunities

We develop high-value technological solutions

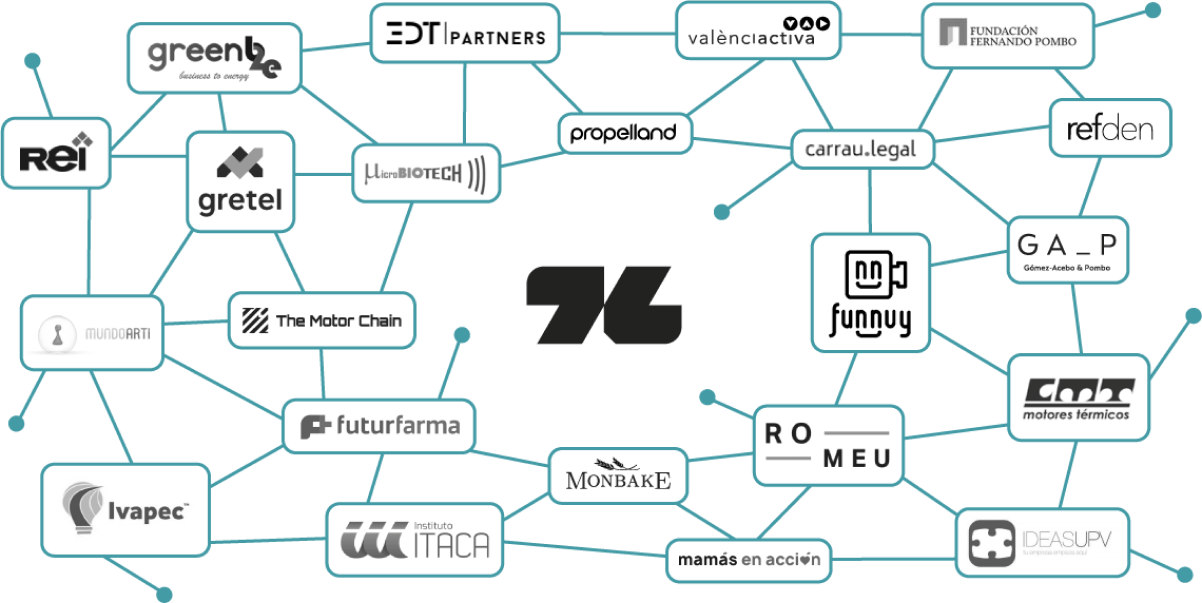

Some of our customers

Do you need a technology partner?

We empower companies seeking to attain new heights through technology. Our mission is to be a trusted partner, leveraging our knowledge and experience to fuel your growth.

Transforma: Exponentia's annual technology event